t mobile taxes and fees florida

Youll see the total monthly cost inclusive of taxes and fees at checkout when youre activating your SIM card or paying for service. 8 Jan 31 2014.

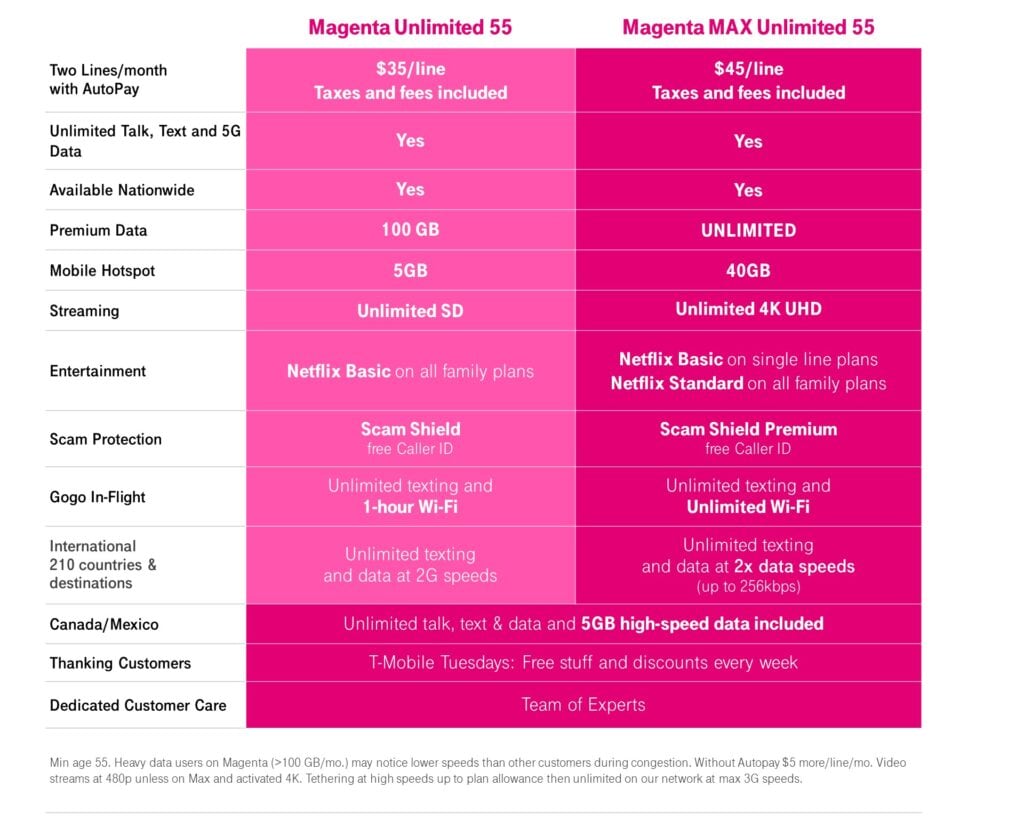

T Mobile Amps 55 Plan With New Max Tier Netflix On Us And More Lines T Mobile Newsroom

According to the consumer tax and spending think tank Tax Foundation average cell phone service fees and taxes have reached 186.

. Florida cell phone taxes tend to be a little higher than Connecticut where I live but a lot lower than some areas in California. The service is by 35orless through T-Mobile and includes conditional call forwarding data roaming and tethering. The below portion is just the taxes and fees above this section was the plan for 100 and 35 for each line and two installments 290.

Other Charges -. Federal State and County Taxes. There are a handful of hidden T-Mobile fees that can be recurring or one-time fees.

My wife has the same as me except she has t-zones for 599 instead of my 2999 internet plan and her tax is exactly the same as mine. 14 rows It varies depending on your plan. T-Mobile cuts unlimited plan pricing.

State and Local Tax 7782. Sales tax and regulatory fees included in monthly rate plan price. View All T-Mobile Plans.

Essentials 55 at 55mo plus taxes fees. Pass does not impact tethering. Ive had tmo for years now and im paying 100 taxes and fees included for 2 lines of unlimited.

State and Local Tax 7782. The only estimate ATT can give you is based on postpaid service for the most expensive tax rate in your state. The Essentials plan will run you 60 for one line 45 each for two 30 each for three and 27 apiece for four lines of service.

US Mobile will never add any hidden fees to your bills. Wondered if anyone on the Essentials 55 plan could help out on what the taxes and. Yes it does seem faster than either metro or mint.

It does not include taxes and fees in the monthly price. Taxes Surcharges 838. Target occasionally has 5 or 10 percent off sales too.

02-20-2007 0736 PM 13. This is the best wireless provider in America. The price drops to just 35 per line compared to 40 from ATT and 45 on Verizon.

This year wireless subscribers will pay approximately 113 billion in taxes fees and government surcharges to. 313 rows A typical American household with four phones on a family share plan paying 100 per month for. If your state charges a 988 fee it is located on the Taxes Fees and Other Charges.

If you pay tmobile you pay sales tax and occasionally varies by state additonal cellphone e911 type fees. My current bill was 2624 for 500 MB data inc. We charge you the State Cost Recovery Charge as a percentage-based fee to cover some of these costs.

You are a fool if youre paying more than 2375 a month for service. One of the biggest perks of T-Mobile is that all taxes and fees are included in the price of their plans. This is based on the state in which you live.

Magenta 55 at 70mo taxes and fees included for 2 lines on autopay and the. A typical American household with four cell phones on a family share plan paying 100 per month for taxable wireless service would pay nearly 300 per year in taxes fees and government surchargesup from 270 in 2020. So the 70 a month unlimited plan for a single line will actually cost just 70 a month.

Total taxes fees for 5 lines is 1968 which is close to 20 of my monthly service fees after corporate. We pay certain taxes to state governments give you service. The Phone Administrative Fee is a per-line per-month fee.

State cost recovery charge we pay certain taxes to state governments to provide you with service. You should expect anywhere from 35 up to 50 for tax. Find the best T-Mobile Internet plans deals in Florida.

My plan is 1500 min 3999 internet 2999 and test messaging 499. Capable device required to experience HD resolution. T-Mobile has download speeds up to 90 Mbps.

TMobile MONEY customers can earn industry-leading interest on checking and savings accounts access to 55000 no-fee ATMs. This isnt a tax that the state requires us to collect. Ago edited 2 yr.

This means that wireless customers are paying an average of 225 per year above and beyond the actual price of their mobile service. LTE unlimited but throttled after the first 500 MB and unlimited talk and text then 152 USF fee and 100 e911. In 2020 the Federal Communications Commission designated 988 as the 3-digit dialing number for the National Suicide Prevention Hotline.

T-Mobile has download speeds up to. On-device streams at up to 1080p. Including taxes and fees saves you an estimated 80-100 per year.

My taxes Fees per line is about 323 and another account level taxfee of 353. Some states have implemented a 988 fee to fund crisis call centers and other services used to respond to 988 calls. Most of those can be circumvented including sales tax by buying e-delivered tmobile prepaid cards from SamsClub or Target.

At mint we dont hide our fees in our planswe break them out so you know exactly what you are paying. Switch to T-Mobile and get more 5G bars in more places. T mobile taxes and fees florida.

The taxes and fees are going to depend on where you live in Florida. My current bill was 2624 for 500 MB data inc. That said T-Mobiles plan is still the most affordable here especially with all taxes and fees included.

The wireless provider announced that customers on the T-Mobile One plan will no longer pay extra for monthly wireless service fees and taxes if they opt-in online. 20 UNLIMITED with T-Mobile ONE voice 65 lineper month standalone. Ad Worry no more get peace of mind with T-Mobiles Price Lock guarantee.

Account restore fee If you have an account that gets suspended or shut down because you didnt pay on time once you reinstate your account they will charge you a hidden fee of 20 plus tax which will show up as a one-time fee for restore on your bill. The Magenta plan gets even better for families too. Florida Department of Revenue Taxation of Mobile Homes in Florida Page 1.

7 plans from 10mo to 85mo. For 2 lines on autopay. Sams is always discounted.

ATT Phone Administrative Fee. T-Mobile does not have a Grace Period for late payments so if you are a day latea fee will. Total taxes fees for 5 lines is 1968 which is close to 20 of my monthly service fees after corporate.

Form 2290 Filing Chart Irs Tax 2290 Filing 2290 Highway Use Tax Form 2290 Heavy Use Tax Irs Taxes Tax Forms Tax Guide

Cell Phone Taxes Fees Calculator Moneysavingpro

Top Travel Money Saving Tips And Tricks Infographic Money Saving Tips Travel Money Travel Infographic

Cell Phone Taxes Fees Calculator Moneysavingpro

Online Bookkeeping Accounting Software Made Easy Godaddy Business Blog Small Business Accounting Software Business Inspiration

Cell Phone Taxes Fees Calculator Moneysavingpro

Cell Phone Taxes Fees Calculator Moneysavingpro

How To Choose Your Domicile State Digital Nomad Digital Nomad Business Digital Nomad Jobs

T Mobile One Plans Go All In On Taxes Fees Android News Google Smartphones Mobile Offers Mobile Phone Company Mobile Phone Deals

5 Income Tax Tips For Notaries And Signing Agents Nna Tax Deductions Tax Preparation Irs Taxes

Cell Phone Tax Rates By State Wirefly

Use Your Signingagent Com Profile As Your Notary Website Notary Signing Agent Notary Notary Public Business

Memory Jogger List Template Why It Is Not The Best Time For Memory Jogger List Template List Template Memories Templates

Sick Of Renting Check Out This Gem In College Park Payments Could Be As Low As 1060 Per Month Principal Interest Taxes Rent Check Real Estate College Park

Original Logo T Shirt White From Bad Suns

Cell Phone Taxes Fees Calculator Moneysavingpro

You Can T Say Corporate Corruption Didn T Have A Good Run With This Deduction Facts Didyouknow Turn Ons Did You Know Sayings